The Spanish National Tax Agency (AEAT) has modified Annexes V and XII of the DUA Resolution corresponding to INCOTERMS codes that affect customs validations and Intrastat declarations. Here we tell you everything you need to know.

Since January 1, 2022, some modifications of Annexes V and XII of the DUA Resolution corresponding to the Delivery Conditions (INCOTERMS) have come into force. To learn more about the 11 types of INCOTERMS currently in force, please consult our articles INCOTERMS OF MARITIME TRANSPORT and INCOTERMS.

Changes Annex V

Some changes in the codes apply to all modes of transport:

- The DPU code (Delivered at Place Unloaded) previously named DAT (Delivered at Terminal) implies that the unloaded delivery is not limited to the delivery at the terminal, it can take place at any previously agreed location.

- The EXW code specifies that the responsibility of the exporter ends by making the merchandise available to the importer at the exporter’s premises.

- The FCA code implies that the seller assumes all costs and risks of transporting the merchandise until its delivery to the agreed location.

Some changes in the codes apply to maritime transport:

- The FAS (Free Alongside Ship) code stipulates that the seller is under obligation to place the merchandise on the dock alongside the designated vessel. This does not imply leaving it in storage or at the terminal.

- Unlike FAS, the FOB code (Free on Board) is applied when the seller has to leave the merchandise loaded on the ship at the designated loading port with the export clearance already carried out.

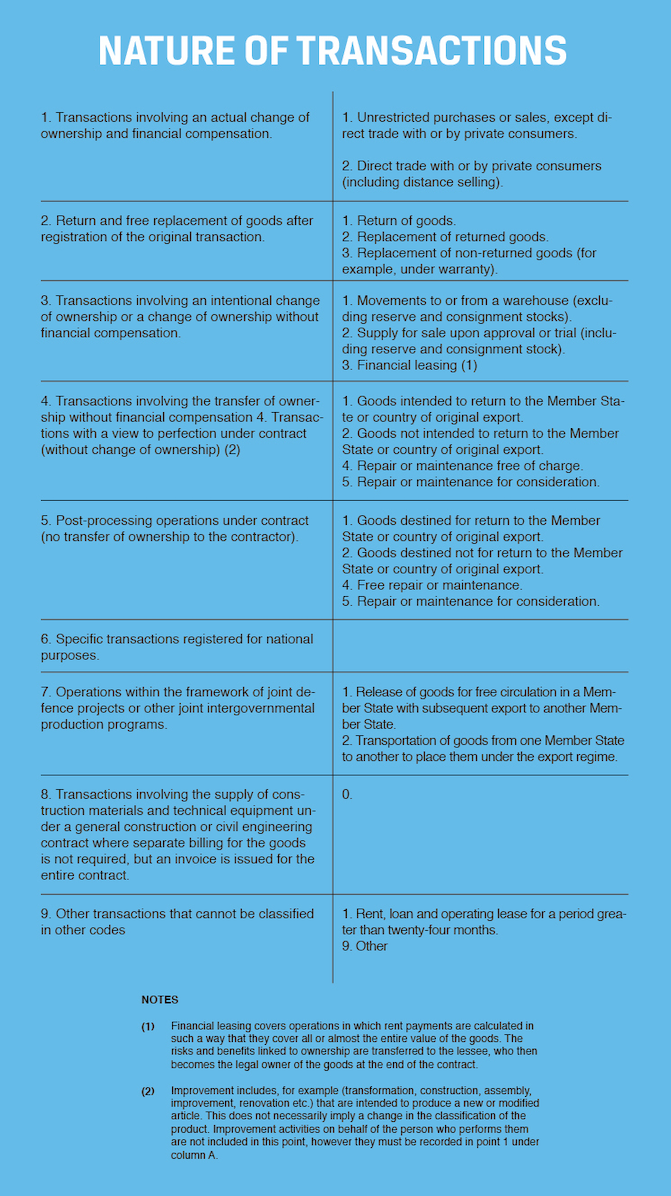

Changes Annex XII

Changes to the nature of the transaction in the DUA:

The codes to determine the nature of transactions have also been updated. It is a two-character code that consists of code A and code B:

The new annexes V and XII can be viewed and downloaded on the Tax Agency website Agencia Tributaria.