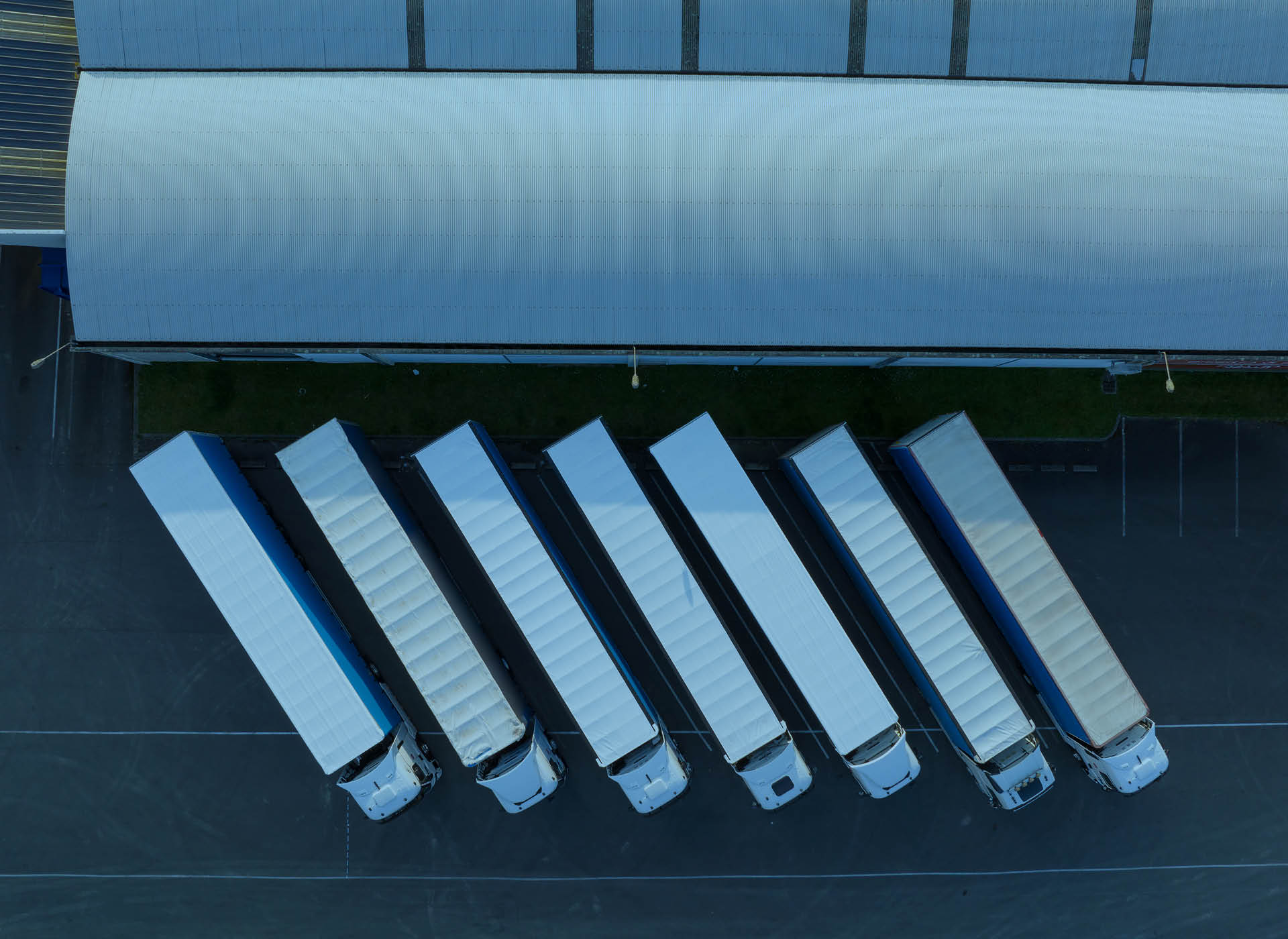

Warehousing plays a crucial role in modern logistics, acting as a link between production, distribution, and the consumer. In an environment where speed and efficiency are key, having a well-managed warehouse network not only reduces operating costs but also improves the customer experience.

Global Data

The rise of e-commerce has exponentially increased the demand for warehousing. In 2024, the global warehousing services market reached a value of €734.6 billion and is expected to grow to €799.8 billion by 2025, with a projection of exceeding €1.07 trillion by 2029. This growth is primarily driven by the digitalization of commerce, automation, and the expansion of distribution networks.

Warehouse Optimization and Efficiency

Today’s warehouses have evolved from simple storage spaces to highly optimized logistics centers. Operational efficiency has become a priority, with automation playing a key role. In 2023, 60% of logistics operators could dispatch an order in less than 90 minutes, compared to 53% in 2022. Furthermore, nearly 30% of orders were prepared in less than 30 minutes.

Space utilization is also a determining factor in efficiency. In 2022, average peak occupancy reached 85.6%, although in 2023 it dropped to 78.5%, reflecting increased available capacity or improvements in inventory distribution. Efficient design and the implementation of advanced warehouse management systems (WMS) make it possible to maximize space utilization and reduce product handling time.

Operating Costs and Investment Trends

Warehouse operating costs have increased significantly in recent years due to inflation, energy prices, and wages. In the United States, for example, the average cost of warehouse space rose from €7.32 per square foot in 2022 to €7.65 in 2024. Similarly, the average wage of a warehouse worker increased from €13.77/hour in 2022 to €15.59/hour in 2024.

The warehousing sector is undergoing a phase of accelerated transformation. With the growth of e-commerce, rising operating costs, and the adoption of advanced technologies, warehouses are evolving to become more efficient, automated, and adaptable to market needs.

To counteract these increases, companies are investing in automation and digitalization. In 2023, around 60% of warehouses planned to increase their automation budget by 20% by 2024, focusing on collaborative robots, artificial intelligence, and autonomous vehicles.

The sector’s growth is also reflected in physical expansion: the total number of warehouses worldwide was approximately 162,500 in 2022, with projections to reach 179,500 by 2025.

The Impact of Automation and Digitalization

New technologies are revolutionizing warehouse management. In 2023, 84% of logistics companies were already using a WMS, compared to 79% in 2022. Furthermore, 25% of warehouses globally have implemented some form of automation, compared to only 5% a decade ago. However, only 10% of warehouses use advanced systems such as autonomous robots or AS/RS (Automatic Storage and Retrieval Systems), suggesting significant room for growth.

The use of collaborative robots in warehouses is increasing rapidly. It is estimated that by 2025, nearly 50,000 warehouses worldwide will have robots assisting with picking and goods handling tasks, compared to just 4,000 in 2019. Furthermore, artificial intelligence and Big Data are enabling more precise inventory management, with 36% of companies planning to invest in predictive analytics in the next five years.

Trends indicate that digitalization and robotization will be key in the coming years, enabling more agile and competitive logistics.

Sources:

– The Business Research Company: Global Warehousing Market Analysis (2023-2024).

– ABI Research: Impact of Automation and Robotization in Warehouses (2023-2024).

– Interact Analysis: Operating Costs and Salary Trends in Logistics (2023-2024).

– SCMR (Supply Chain Management Review): Study on Warehouse Optimization and Efficiency (2023).

– Deloitte and McKinsey reports on the digitalization and adoption of WMS in global logistics (2023-2024).

This data has been extracted from specialized sources and leading consulting firms in the logistics industry, ensuring its up-to-dateness and relevance for understanding the evolution of the global warehousing sector.